Who Pays Federal Income Taxes in Pensacola?

Haas Center | February 5, 2019

The Internal Revenue Service annually provides detailed statistics on federal filers. It includes information on income, dependents, tax credits and other information from tax forms. These data are lagged, with the most recent information being for the 2016 tax year. A look at the information provides a few interesting insights into Pensacola area tax payers:

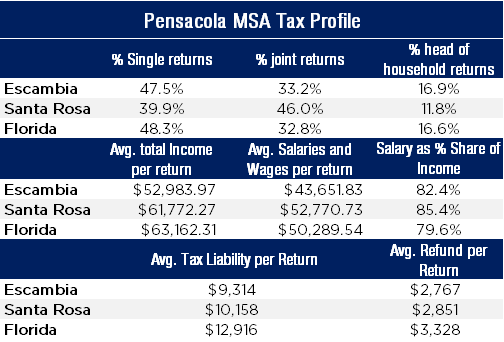

- Santa Rosa has significantly more joint filers than Escambia and the state.

- Average total income is higher than salary and wage income – but there are big differences in the amount that represents salaries.

- The average tax liability and refund are higher for the state than in the Pensacola area.

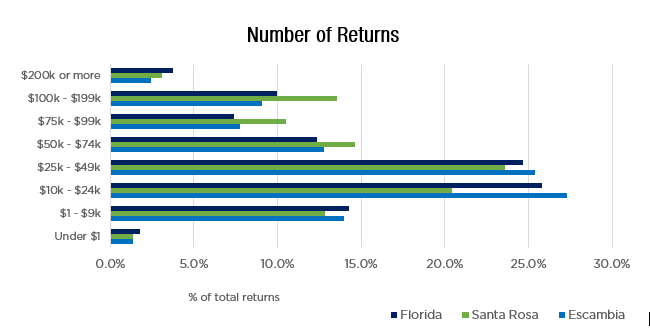

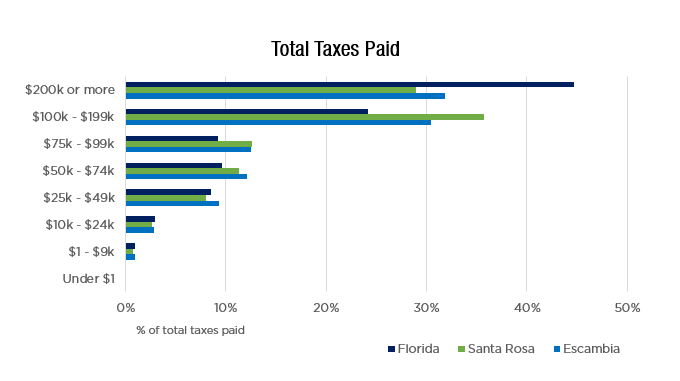

Roughly three-quarters of returns deal with less than $75,000 in Adjusted Gross Income, but three-quarters of all taxes are paid by those with $75,000 Adjusted Gross Income or higher.