Pandemic Creates New Challenges for Minority-Owned Small Businesses

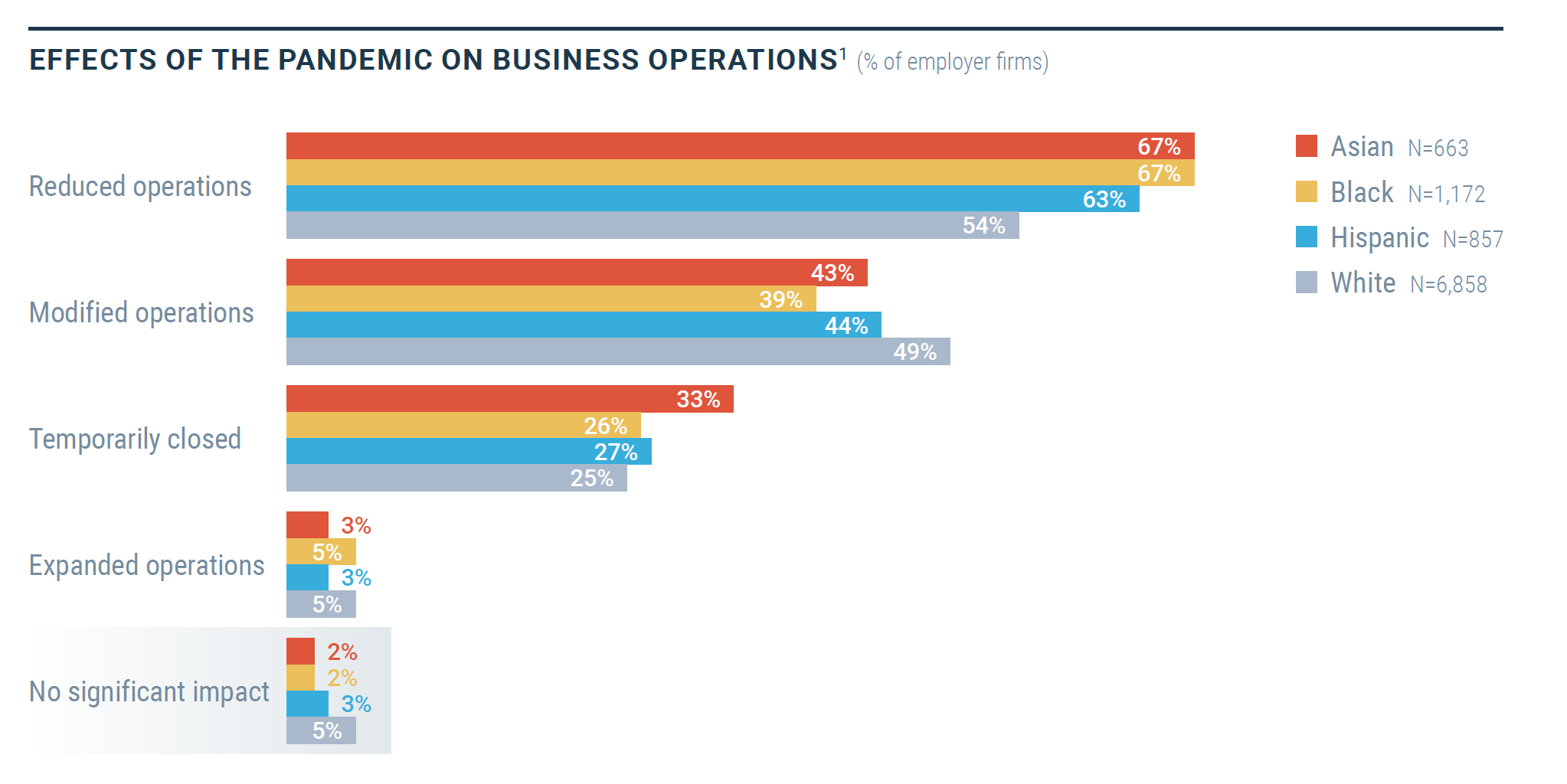

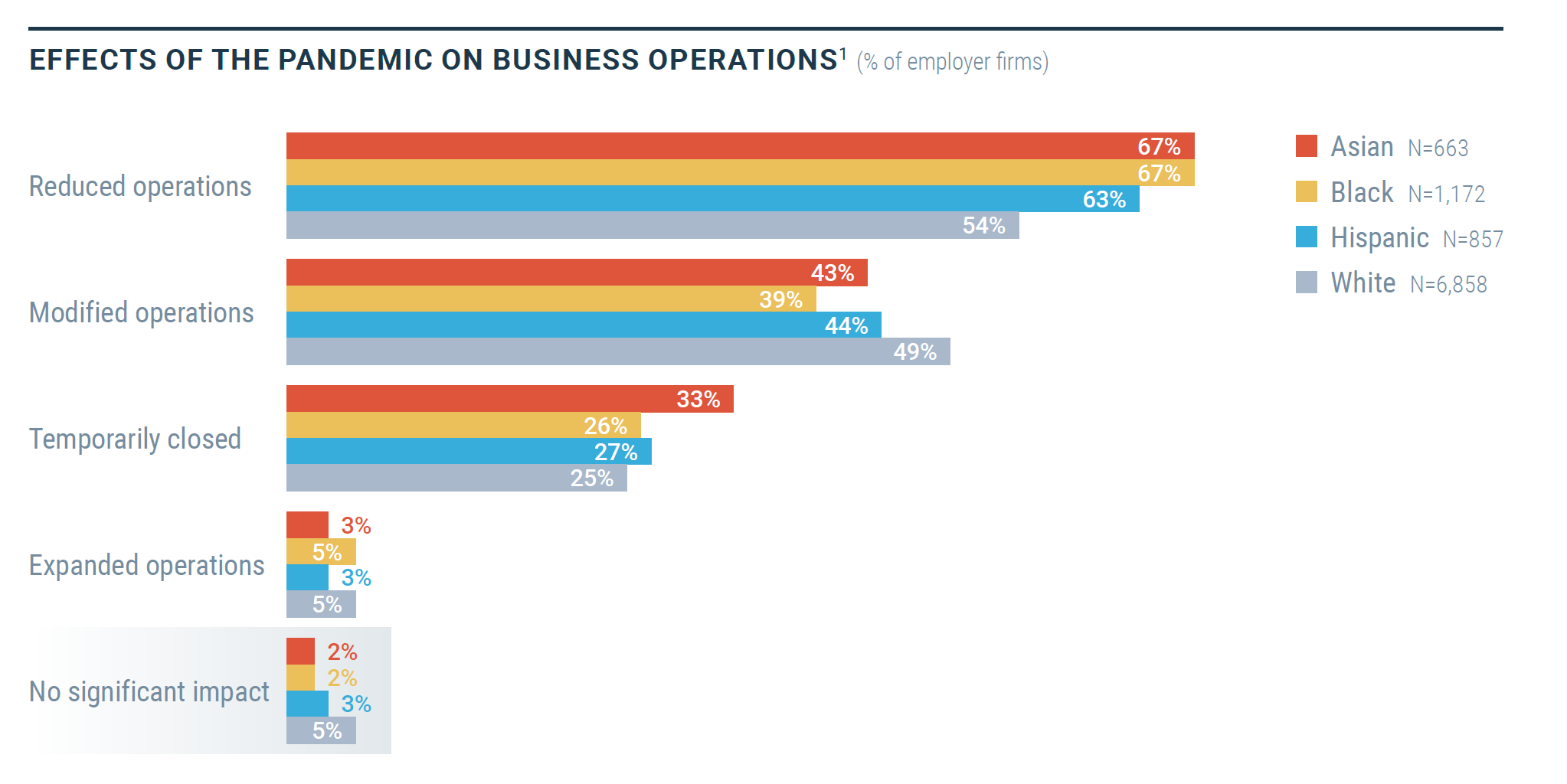

The Federal Reserve conducted a small business survey and found that firms owned by people of color were among the firms most likely to experience financial and operational challenges stemming from the pandemic.

Read the full Federal Reserve Small Business Credit Survey today!

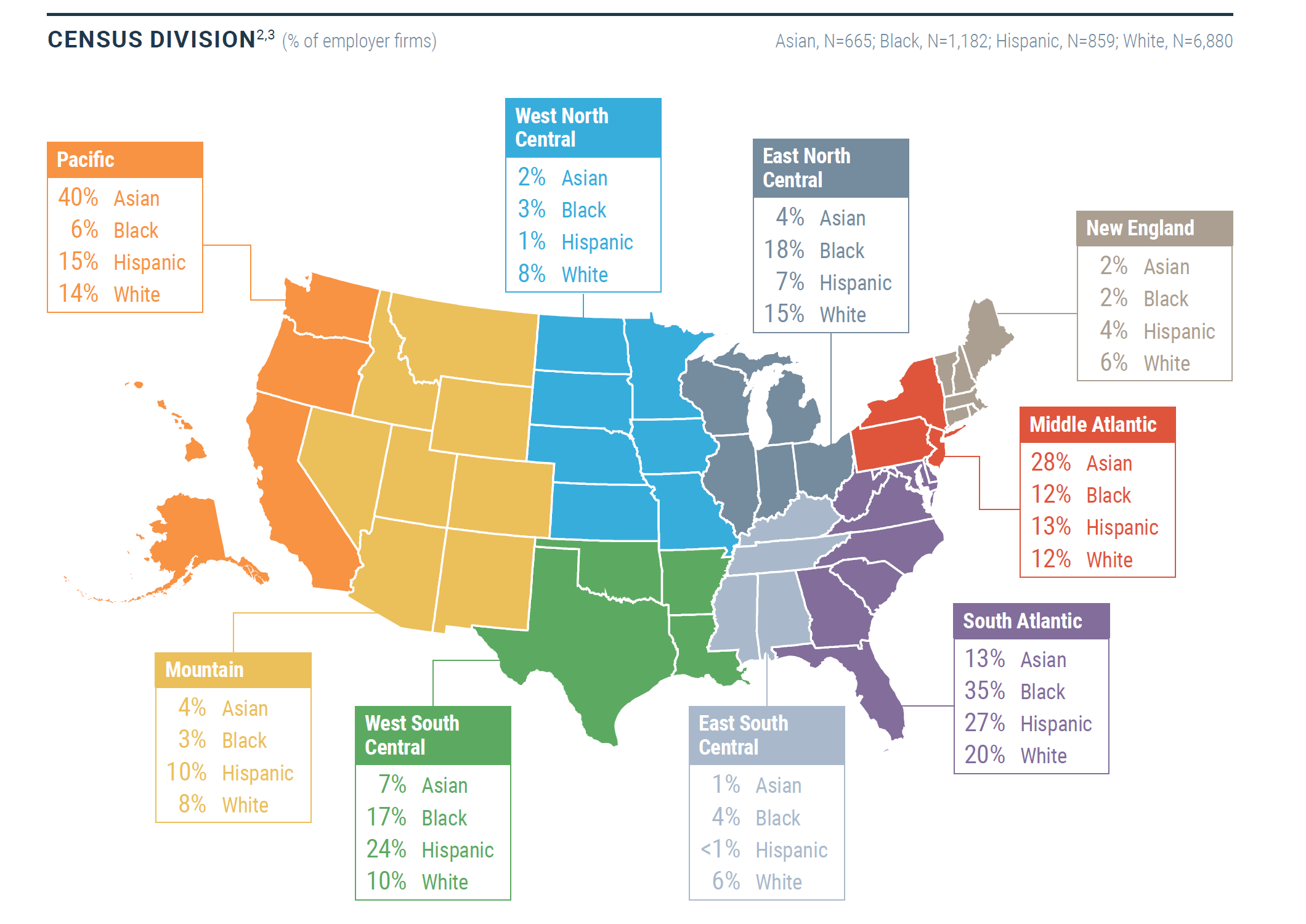

The document breaks down different findings such as geographic breakdown of businesses by ethnicity of owners, what industries these small businesses are in, revenue growth over a five year period, and firm supply chain. For instance, the survey found patterns in geographic concentration by race and ethnicity. This is important due to the different ways state governments responded to the global pandemic. For example, 40% of Asian-owned small businesses were located in the Pacific census division, and another 28% were in the Middle Atlantic. These areas had more aggressive policies earlier on which may have affected the revenue performance of Asian-owned firms.

Another highlight is that firms owned by people of color were morel ikely than white-owned firms to report that they reduced their operations in rsponse to the pandemic. Asian-owned firms were more likely than others to have temporarily close.

Firms owned by people of color were also more likely than white-owned firms to report their firms experienced financial challenges in the prior 12 months. These three highlights below represent just a few findings from this report.