More than a map—geographic information system (GIS) helps us to answer the question "where?" The UWF GeoData Center guides our partners, students, faculty and staff using geospatial technologies that change the way we view the world. Through collaborative analysis and visualization, we use cutting edge applications of GIS technologies in order to inform and deliver innovative solutions to critical societal issues.

With applications in a wide variety of industries and occupations, our GIS undergraduate and graduate certificates and master’s degree in Geographic Information Science Administration prepare our students to become interdisciplinary data scientists and highly skilled GIS professionals.

UWF is the only University in Florida designated as an ESRI Development Center (EDC). The EDC program confers special status and benefits upon a select few leading university departments that challenge their students to develop innovative applications based upon the ArcGIS platform.

Programs

UWF GIS offers undergraduate and graduate certificates as well as a GIS Admin, M.S., that incorporates a business core for career advancement.

GIS ProgramsServices

The UWF GeoData Center leverages the latest geographic data information technology to help our clients make informed decisions that solve complex problems.

ServicesPortfolio

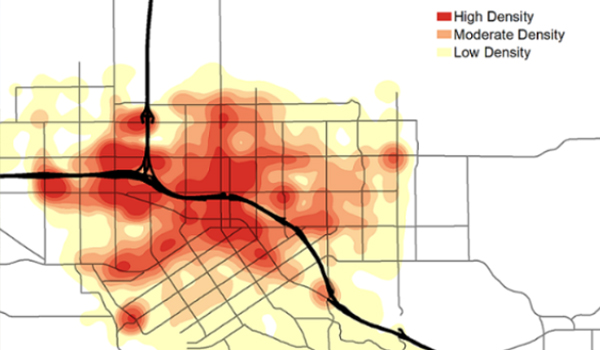

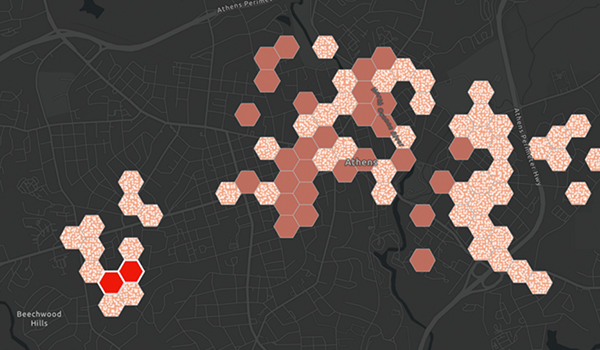

UWF GeoData Center and GIS student research and projects showcase the creation of maps, software applications and code, and other geospatial tools.

Portfolio